Payin via Virtual Account

Transform your fiat-to-crypto operations with NOAH's Virtual Account solution. Accept bank transfer payments in local currency and receive instant settlement in cryptocurrency—eliminating conversion delays while significantly reducing operational costs compared to traditional crypto onramps.

Accept bank transfer payments in fiat and receive immediate settlement in crypto.

The Business Challenge

Traditional fiat-to-crypto conversion is holding back your growth:

- Complex multi-step processes confuse customers and increase drop-off rates

- Manual reference codes create errors, failed transactions, and customer support headaches

- Delayed settlements tie up working capital for days

- High conversion fees eat into profit margins

- Limited payment methods restrict customer acquisition

- Manual reconciliation increases operational overhead and error rates

Our Solution

NOAH's Virtual Account solution automates fiat-to-crypto conversion by providing each customer with a unique bank account number (IBAN, ACH routing) for direct deposits. When customers send fiat to their dedicated account, our system automatically converts it to your chosen cryptocurrency and settles instantly to your business account—with optional automatic fee deduction.

How It Works (Business View):

- Generate unique account for each customer (IBAN for EUR, ACH routing for USD)

- Customer deposits fiat directly to their dedicated bank account number

- Automatic conversion to your specified cryptocurrency at real-time market rates

- Instant settlement to your NOAH business account with optional fee withholding

- Optional auto-withdrawal to customer's external wallet if required

- Complete reconciliation through webhooks and business dashboard

Our Bank Onramp Workflow executes cost-optimized transactions in a seamless automated sequence, with your system notified at each step through webhooks for complete visibility and control.

Key Business Benefits

Customer Experience Excellence

- Eliminate drop-off: Unique account numbers remove reference code confusion, significantly reducing abandonment

- Faster transactions: Direct bank transfers are familiar and trusted by customers

- Error reduction: No manual reference entry eliminates most transaction errors

- Simplified refunds: Dedicated accounts make refund processing instant and automatic

- Trusted payment methods: Bank transfers provide security and familiarity customers expect

Operational Efficiency

- Automated processing: End-to-end workflow requires zero manual intervention

- Instant settlements: Funds available immediately rather than traditional multi-day delays

- Simplified reconciliation: Unique accounts make transaction matching effortless

- Reduced support tickets: Fewer errors mean substantially fewer customer service inquiries

- Single integration: One endpoint handles the entire conversion workflow

Revenue Optimization

- Automatic fee collection: System withholds your service fees during conversion

- Real-time pricing: Mid-market exchange rates maximize conversion value

- Lower operational costs: Automation significantly reduces processing costs

- Improved margins: Transparent fee structure and automatic collection improve profitability

- Available fee withdrawal: Accumulated service fees can be withdrawn anytime

Business Growth

- Market expansion: Support customers across 27 European countries via SEPA

- Scalable operations: Handle volume growth without proportional staff increases

- Competitive advantage: Offer superior user experience vs. traditional onramps

- Brand control: White-label solution maintains your customer relationship

Use Cases by Industry

Cryptocurrency Exchanges

Challenge: Customers need simple, reliable ways to deposit fiat and receive crypto Solution: Unique bank accounts for each customer eliminate reference codes and errors Benefit: Reduce customer onboarding friction and support costs substantially

Gaming & NFT Platforms

Challenge: Players want easy fiat-to-crypto conversion to purchase in-game assets Solution: Seamless bank transfer to crypto conversion with automatic wallet delivery Benefit: Increase conversion rates and significantly reduce payment abandonment

Investment Platforms

Challenge: Investors need reliable, cost-effective ways to fund crypto portfolios Solution: Direct bank deposits with instant crypto settlement and fee transparency Benefit: Attract traditional investors comfortable with bank transfers

E-commerce Platforms

Challenge: Accept fiat payments while settling in crypto for international expansion Solution: Traditional payment experience with crypto settlement benefits Benefit: Access global markets while maintaining crypto treasury advantages

Virtual Account Workflow System

Our automated Bank Onramp Workflow provides a comprehensive payment solution through intelligent automation:

Unique Account Assignment: Each customer receives dedicated bank account details (IBAN for EUR, ACH routing for USD coming soon), eliminating reference codes and associated errors.

Automated Conversion Process: Deposited fiat is automatically converted to your specified stablecoin or cryptocurrency using real-time market rates from top exchanges.

Flexible Settlement Options:

- Crypto remains in your NOAH business account for immediate use

- Optional automatic withdrawal to customer's external wallet addresses

- Configurable fee withholding from converted cryptocurrency

Complete Transparency: Full workflow visibility through webhooks and reconciliation via NOAH's business dashboard.

Implementation Overview

Business Requirements

- Timeline: 1-2 weeks from contract to go-live for white-label integration

- Resources: Minimal technical resources required for single endpoint integration

- Compliance: NOAH handles banking relationships and regulatory requirements

- Training: Standard onboarding process for your operations team

Integration Options

White-Label Integration

- Complete control: Full control of user flows and branding within your application

- Single endpoint: Integrate with one back-end call to handle entire conversion workflow

- Custom experience: Seamlessly add fiat-to-crypto capabilities to existing platform

- Brand maintenance: Maintain customer relationships throughout the process

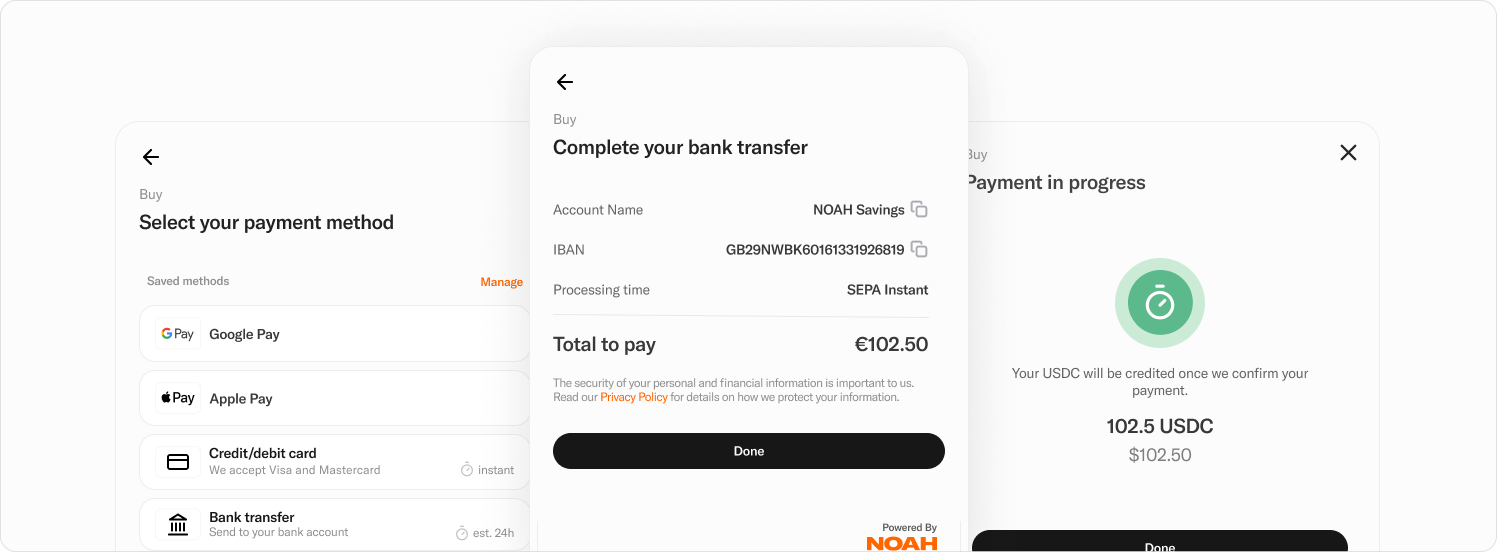

Hosted Onramp Interface

- Streamlined setup: Consumer-friendly interface guides users through bank transfer process

- Multiple payment methods: Access to additional fiat payment options beyond bank transfers

- Reduced development: Minimal integration effort for immediate market access

- Enhanced features: Leverage broader payment ecosystem for comprehensive solutions

What We Handle

- Banking relationships: Established connections with financial institutions across supported regions

- Regulatory compliance: Full compliance framework across all supported jurisdictions

- Currency exchange: Real-time conversion at competitive mid-market rates

- KYC processing: Choose between customer KYC-share or utilize NOAH's global compliance framework

- Transaction monitoring: Automated fraud detection and prevention

- Settlement processing: Instant crypto settlement and optional auto-withdrawals

What You Control

- Fee structure: Configure service fee percentages and collection methods

- Customer experience: Design user flows that match your brand and requirements

- Settlement preferences: Choose to hold crypto or auto-withdraw to external wallets

- Notification handling: Receive real-time webhooks for complete workflow visibility

Supported Payment Methods & Coverage

Current Fiat Payment Methods

- EUR/SEPA Bank Transfer: Live across 27 European countries

- US ACH / Wire Transfers: Coming soon for North American market expansion

Supported Cryptocurrencies & Networks

| Digital Currencies | Bitcoin | Lightning | Ethereum | Polygon | TRON | Stellar | Solana | Celo |

|---|---|---|---|---|---|---|---|---|

| BTC | ✓ | ✓ | ||||||

| USDC | ✓ | ✓ | ✓ | ✓ | ✓ | |||

| USDT (coming soon) | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| cUSD (coming soon) | ✓ |

European Market Coverage (SEPA)

Currently supporting 27 European countries with EUR bank transfer capabilities:

Western Europe: Austria, Belgium, France, Germany, Ireland, Italy, Luxembourg, Netherlands, Spain Northern Europe: Denmark, Estonia, Finland, Latvia, Lithuania, Sweden Central Europe: Croatia, Czech Republic, Hungary, Poland, Slovakia, Slovenia Southern Europe: Bulgaria, Cyprus, Greece, Malta, Portugal, Romania

US ACH and Wire transfer support coming soon to expand North American market access.

Pricing & Business Model

Transparent Fee Structure

- Low-code integration: Single endpoint significantly reduces development costs

- Real-time exchange rates: Mid-market rates aligned with top currency exchanges

- Automatic fee collection: System handles service fee deduction and accumulation

- No hidden charges: Complete fee transparency with real-time pricing

- Instant settlement: No working capital delays or additional financing costs

Revenue Optimization

- Configurable service fees: Set fee amounts automatically collected during conversion

- Immediate availability: Accumulated fees available for withdrawal anytime

- Improved margins: Lower operational costs and automated collection increase profitability

- Reduced processing costs: Significant savings vs. traditional conversion methods

- Enhanced customer lifetime value: Better experience increases retention and transaction volume

Risk Management & Compliance

Regulatory Framework

- Banking partnerships: Established relationships with licensed financial institutions

- Compliance coverage: Full regulatory compliance across all supported jurisdictions

- KYC flexibility: Choose customer KYC-share model or utilize NOAH's compliance framework

- Transaction monitoring: Automated AML and fraud detection systems

- Audit capabilities: Complete transaction trails for regulatory reporting

Business Protection

- Error reduction: Unique accounts eliminate most transaction errors and disputes

- Automated reconciliation: Simplified accounting and financial reporting

- Fraud prevention: Real-time monitoring and automated risk assessment

- Refund automation: Streamlined refund processing reduces operational burden

- Insurance coverage: Protection against operational and technical risks

Getting Started

Evaluation Process

- Business consultation: Discuss your specific conversion requirements and volume projections

- Technical assessment: Review integration approach and timeline requirements

- Pilot program: Start with limited customer segment to validate performance

- Full deployment: Scale to complete customer base with ongoing optimization

Implementation Steps

- Choose integration type: White-label vs. hosted solution based on your requirements

- Configure workflow: Set up conversion currencies, fee structures, and settlement preferences

- Integrate endpoint: Single API integration for complete workflow automation

- Test and validate: Comprehensive testing with sample transactions

- Go live: Launch with full customer access and monitoring

Next Steps

- Schedule a demo: See the solution in action with your specific use case

- Review technical requirements: Assess integration effort and timeline

- Pilot planning: Design limited rollout to validate business impact

- Contract and launch: Begin processing within 1-2 weeks

Ready to eliminate fiat-to-crypto friction? Contact our business development team to schedule a consultation and see how NOAH's Virtual Account solution can accelerate your customer acquisition and reduce operational costs.

For technical integration details, see your Payin via Virtual Account Journey.